Business Insurance in and around Newbury Park

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all on your own. State Farm agent Tina Klaas, a fellow business owner, is not unaware of the responsibility on your shoulders and is here to help you get started on a policy that's right for your needs.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Keep Your Business Secure

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are an electrician or an optometrist or you own a bagel shop or a shoe repair shop. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Tina Klaas. Tina Klaas is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

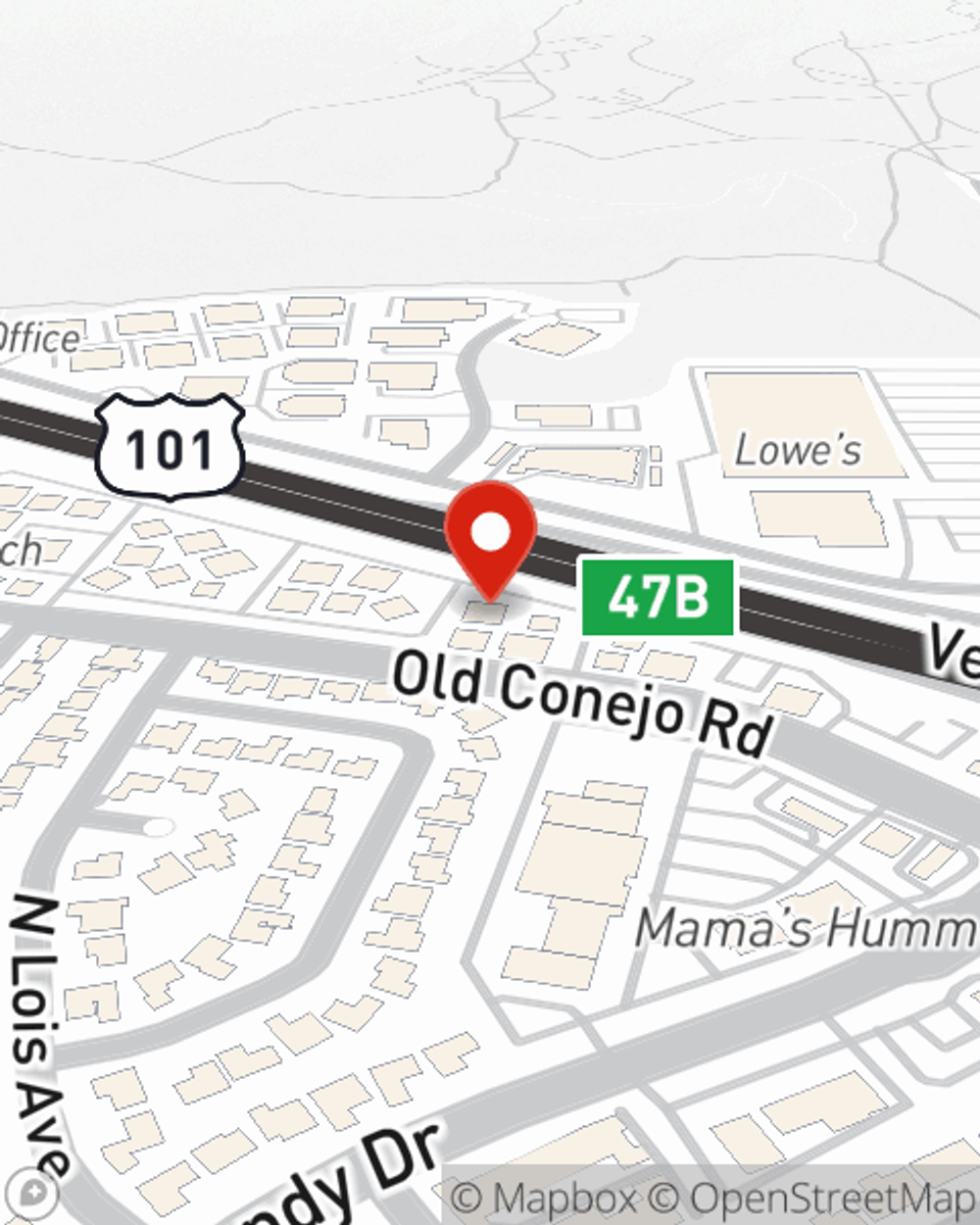

Reach out to State Farm agent Tina Klaas today to find out how one of the leaders in small business insurance can ease your business worries here in Newbury Park, CA.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Tina Klaas

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.